To secure a home loan for a unit at the prestigious Marina Gardens Lane Condo in Singapore's Marina South district, prospective buyers must be well-prepared. This involves organizing financial documentation, understanding the loan application process, and being aware of the eligibility requirements specific to Singapore citizens or permanent residents. Applicants must have a consistent income source, a favorable credit history, and comply with loan-to-value (LTV) ratio limits that vary with different loan tenures. It's recommended to consult with multiple financial institutions to compare loan offers and find the best terms based on one's financial status. The process includes a financial assessment, pre-approval, property valuation, and signing of loan agreements. Prospective buyers should be knowledgeable about the real estate market in Marina South and monitor loan terms and interest rates throughout this journey to ensure informed decision-making when purchasing a unit at Marina Gardens Lane Condo.

Welcome to an insightful guide on navigating the Marina Gardens Lane Condo loan application process within the vibrant Marina South district. This article meticulously outlines the steps involved in securing a home loan for your dream residence at Marina Gardens Lane Condo, ensuring you’re well-informed and prepared for each stage. Whether you’re a first-time borrower or looking to invest in the prestigious Marina South area, understanding the eligibility criteria specific to this location is key. We’ll walk you through a comprehensive step-by-step guide tailored to the unique financial considerations of purchasing property here. Embark on your journey to homeownership with confidence, leveraging the insights provided in this article to make informed decisions about your Marina Gardens Lane Condo loan application.

- Understanding the Marina Gardens Lane Condo Loan Application Process

- Eligibility Criteria for Prospective Borrowers at Marina South

- Step-by-Step Guide to Securing a Home Loan for Marina Gardens Lane Condo

Understanding the Marina Gardens Lane Condo Loan Application Process

When applying for a loan to finance your home in the prestigious Marina Gardens Lane Condo within Marina South, it’s crucial to familiarize yourself with the application process. This meticulously planned residential area is designed to offer an urban oasis, complete with all the amenities you require. The loan application journey begins with assessing your financial standing, which includes a review of your income, employment stability, and existing debts. Lenders will evaluate these factors to determine your creditworthiness and ability to repay the loan.

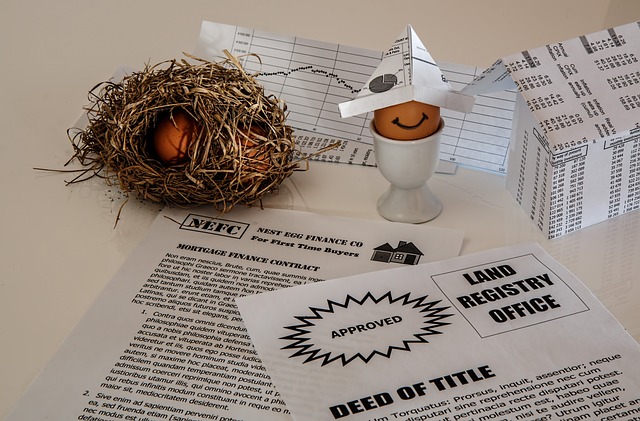

Prospective homeowners should gather necessary documents such as proof of income, recent bank statements, and identification prior to initiating the application. The Marina Gardens Lane Condo loan application process involves several steps, including pre-approval, where lenders estimate the amount you can borrow based on your financial information. Subsequently, you’ll proceed with a formal application, which entails a thorough check of your credit score and history. It’s advisable to compare offers from multiple lenders to secure the most favorable terms for your loan. Understanding this process in advance can streamline the application experience and bring you closer to realizing the dream of owning a home at Marina Gardens Lane Condo, nestled in the vibrant Marina South district.

Eligibility Criteria for Prospective Borrowers at Marina South

Prospective borrowers interested in securing a loan for a unit at Marina Gardens Lane Condo within the vibrant Marina South district should first familiarize themselves with the eligibility criteria set forth by financial institutions. These criteria are designed to ensure that applicants are well-positioned to manage the financial commitments associated with property ownership. Applicants must be Singapore citizens or permanent residents, and they typically need a stable income source, demonstrating a regular monthly salary. Additionally, credit history plays a significant role; a good credit score is often a prerequisite for loan approval. The loan-to-value (LTV) ratio is another factor to consider, with different LTV limits applicable for different loan tenures. Marina South’s appeal as an upscale residential area means that properties like those at Marina Gardens Lane Condo come with premium pricing, which in turn influences the size of the loan one can qualify for. Prospective borrowers must also meet financial institution-specific requirements, such as income ceiling limits and other qualifying conditions. It’s advisable to engage with multiple financial institutions to compare terms and conditions, ensuring that the chosen loan aligns with one’s financial capabilities and long-term financial planning. Understanding these eligibility criteria is crucial for a smooth loan application process at Marina Gardens Lane Condo in the heart of Marina South.

Step-by-Step Guide to Securing a Home Loan for Marina Gardens Lane Condo

To successfully secure a home loan for a unit in the prestigious Marina Gardens Lane Condo within the vibrant Marina South district, prospective homeowners must navigate through a series of well-defined steps. The first step involves thorough research and selection of the ideal property within the Marina Gardens Lane Condo development, which is renowned for its luxury living and central location offering convenient access to various amenities. Once the desired unit is identified, potential buyers should gather all necessary financial documents, including proof of income, recent bank statements, and assets.

Next, homebuyers must approach a bank or a licensed moneylender that offers competitive home loan rates. It’s advisable to compare different financial institutions to find the most favorable loan terms. Upon selecting a lender, applicants should submit a complete application along with all required documentation. The lender will then assess the applicant’s creditworthiness and financial standing to determine eligibility for the loan. This evaluation includes scrutinizing the applicant’s debt-to-income ratio, credit score, and other financial obligations.

Once pre-approved, applicants can proceed with making an offer on their chosen unit at Marina Gardens Lane Condo. After the offer is accepted, the lender will conduct a valuation of the property to ensure it aligns with the loan amount being sought. Following successful valuation and approval, the loan application process will move forward to finalization. This involves signing the necessary loan agreements and documents, after which the property purchase can be completed. Throughout this process, staying informed about loan terms, interest rates, and the conditions of the Marina South property market is crucial for making informed decisions.

When contemplating the acquisition of a unit at the prestigious Marina Gardens Lane Condo in the vibrant district of Marina South, prospective homeowners will find the loan application process both accessible and straightforward. This article has demystified each step involved, from verifying eligibility to navigating the application procedure with clarity. With detailed insights into the criteria set for prospective borrowers and a comprehensive guide tailored for securing a home loan, potential residents are well-equipped to embark on this exciting journey. The Marina Gardens Lane Condo loan application process is designed to facilitate smooth transactions, ensuring that your dream of residing in the heart of Marina South becomes a reality.